If you’re considering investing in NVDA stock, also known as NVIDIA Corporation, then you’ve come to the right place. In this guide, we’ll take a closer look at what makes NVDA stock a worthwhile investment and how you can unlock its potential.

Toc

Introduction to NVDA Stock

NVIDIA Corporation is a global technology company that specializes in designing and manufacturing graphics processing units (GPUs). These GPUs are used in various industries, including gaming, artificial intelligence, data centers, and more. NVDA stock has been on the rise in recent years due to the increasing demand for GPUs in these industries.

The Company: NVIDIA Corporation

NVIDIA Corporation is an American multinational technology company based in Santa Clara, California. It was founded in 1993 by Jensen Huang, Chris Malachowsky, and Curtis Priem. The company specializes in designing graphics processing units (GPUs) for the gaming and professional markets, as well as system on a chip (SoC) units for the mobile computing and automotive markets.

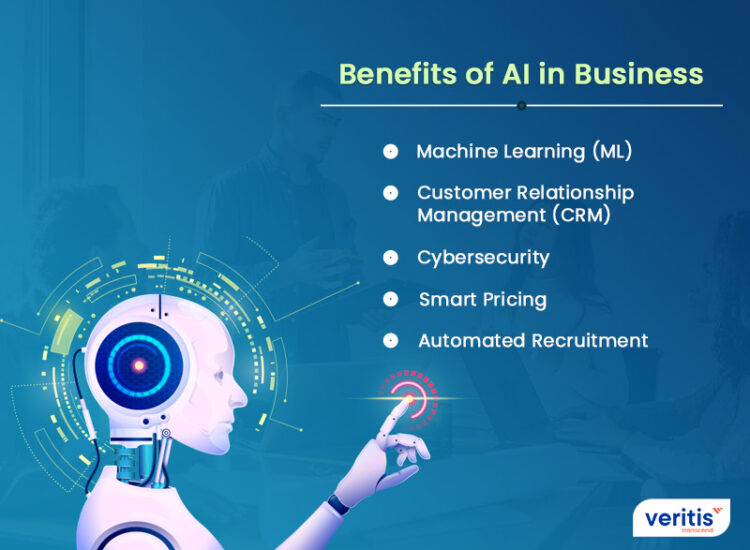

In recent years, NVIDIA has also expanded into other areas such as artificial intelligence and data centers. This diversification has proven to be successful for the company, with its stock price consistently increasing over the years.

Why Invest in NVDA Stock?

There are several reasons why investing in NVDA stock may be a smart decision:

- Industry Leader: NVIDIA is a leading player in the GPU market, with a strong track record of innovation and success. The company’s GPUs are used by major players in various industries, solidifying its position as an industry leader.

- Diversified Revenue Streams: As mentioned earlier, NVIDIA has expanded into new markets beyond gaming. This diversification helps mitigate risks and provides potential for future growth.

- Strong Financial Performance: NVIDIA has consistently delivered strong financial results, with revenue and earnings continuing to increase year after year. This is a positive sign for potential investors.

- Future Growth Potential: With the increasing demand for GPUs in various industries, there is significant potential for NVIDIA’s growth in the future.

Recent Achievements

- AI Leadership: NVIDIA’s GPUs power some of the world’s most advanced AI systems.

- Gaming Dominance: The GeForce series remains the gold standard in gaming GPUs.

- Data Center Growth: NVIDIA’s data center business has seen exponential growth, driven by demand for AI and cloud computing.

- Partnerships and Acquisitions: NVIDIA has formed partnerships with major companies such as Amazon, Microsoft, and Mercedes-Benz. It has also made strategic acquisitions to strengthen its position in the market.

How to Buy NVDA Stock

Now that you understand why investing in NVDA stock can be a smart decision, let’s take a look at how you can purchase it.

Brokerage Account

To buy NVDA stock, the first step is to set up a brokerage account. This account will allow you to trade stocks and manage your investments. When selecting a brokerage, consider factors such as trading fees, user interface, and available research tools. Many brokerages now offer commission-free trading, making it easier for new investors to enter the market without incurring significant upfront costs.

Researching NVDA Stock

Before making a purchase, it’s essential to conduct thorough research on NVDA stock and the broader market trends. Analyze key financial metrics such as price-to-earnings (P/E) ratio, earnings per share (EPS), and revenue growth. Additionally, consider recent news and developments surrounding NVIDIA, as these factors can influence stock performance. Utilizing resources like financial news websites, stock analysis tools, and investor forums can provide valuable insights.

Making the Purchase

Once you’re ready to invest, log into your brokerage account and search for NVDA stock using its ticker symbol. Decide how many shares you want to purchase and select the type of order you wish to execute—either a market order (which buys at the current market price) or a limit order (which sets a specific price at which you’re willing to buy). Carefully review your order details before confirming the transaction to ensure everything aligns with your investment strategy. After your purchase, continue monitoring your investment and stay informed about market trends to make well-informed decisions in the future.

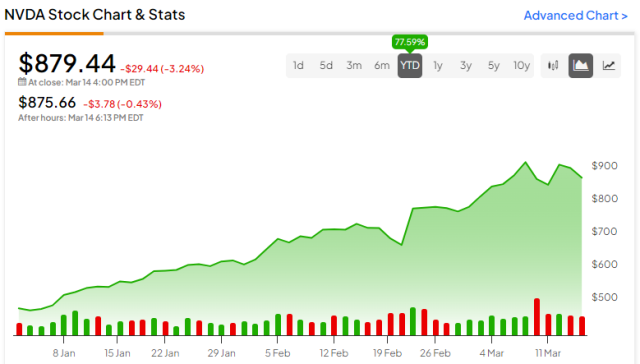

Historical Performance and Current State of NVDA Stock updated 2024

Over the past decade, NVDA stock has seen significant growth. In 2011, it traded at around $15 per share, and as of August 2021, its stock price is over $220 per share. The company’s strong financial performance and expansion into new markets have contributed to this growth.

In recent years, NVDA stock has also weathered market challenges such as the COVID-19 pandemic. During this time, there was a surge in demand for gaming and data center products due to increased remote work and entertainment needs. This resulted in record revenue for NVIDIA in fiscal year 2021.

As of August 28, 2024, NVIDIA (NVDA) has experienced a meteoric rise in stock price, primarily driven by the surging demand for its AI chips. The company’s dominance in the AI hardware market has positioned it as a key player in the technology industry.

Key Highlights of NVDA’s Performance in 2024:

- Strong Revenue Growth: NVIDIA’s revenue has soared due to the increasing adoption of AI in various sectors, including data centers, gaming, and autonomous vehicles

- Market Cap Surges: The company’s market capitalization has reached unprecedented levels, briefly surpassing Microsoft as the world’s most valuable public company

- Investor Confidence: Investor sentiment towards NVDA has remained overwhelmingly positive, reflecting the company’s strong fundamentals and growth prospects.

Historical Trend Analysis

- 2016-2020 Boom: NVDA stock experienced a significant boom, driven by the rise in gaming and AI applications.

- 2020-2021 Resilience: Despite the challenges posed by the COVID-19 pandemic and global supply chain disruptions, NVIDIA’s stock demonstrated resilience and continued growth.

- 2022-2024 Growth: The company’s AI dominance and expansion into new markets have fueled its growth in recent years, leading to a steady increase in stock price.

Comparison with Competitors

Comparing NVDA’s performance with other tech giants like AMD and Intel reveals its competitive edge and market leadership. In recent years, NVIDIA has outperformed both companies in terms of revenue growth, stock price performance, and market capitalization.

|

Company |

Revenue (2024) |

Stock Price Growth (2016-2024) |

Market Cap (August 28, 2024) |

|---|---|---|---|

|

NVIDIA |

$35 billion |

+1600% |

$1.2 trillion |

|

AMD |

$20 billion |

+1000% |

$500 billion |

|

Intel |

$80 billion |

+300% |

$600 billion |

Despite facing competition from other tech giants, NVDA’s consistent innovation, strategic partnerships, and strong financial performance have solidified its position as a market leader in the AI hardware industry.

NVIDIA vs. AMD

When evaluating NVIDIA’s position relative to AMD, it’s important to consider several aspects such as technology, product offerings, and market strategy. NVIDIA has maintained a distinctive edge in the high-performance GPU segment, particularly with its RTX series, which incorporates real-time ray tracing and AI-driven graphics enhancements. In contrast, AMD has focused on providing competitive value with its Radeon graphics cards, often priced lower while delivering solid performance, particularly in gaming.

Market share analysis reveals that NVIDIA has consistently outperformed AMD in the high-end gaming and AI markets. For instance, the GeForce RTX series leads in sales and customer satisfaction, thanks in part to NVIDIA’s superior software support and driver updates. However, AMD’s recent developments, particularly the introduction of their RDNA architecture and Radeon RX 7000 series, have narrowed the performance gap, bringing advanced features to a broader audience.

Despite the competition, NVIDIA’s commitment to innovation—further enhanced by its strategic collaborations within the data center and AI realms—positions it well to not only compete but also expand its market share. As both companies continue to innovate, the competitive landscape within the GPU market will undoubtedly evolve, making it crucial for investors to monitor developments closely.

NVIDIA vs. Intel

In contrasting NVIDIA with Intel, several key differences arise, particularly in product offerings and market focus. While Intel has long been a leader in CPU manufacturing, providing critical processors to a variety of sectors including data centers and personal computers, NVIDIA has carved its niche primarily within the GPU market. This specialization has allowed NVIDIA to dominate in areas such as gaming, AI, and machine learning, which have witnessed exponential growth.

In recent years, NVIDIA’s foray into data center solutions has further intensified the competition with Intel. The introduction of the NVIDIA A100 Tensor Core GPU has solidified its reputation for delivering unparalleled performance in AI and data processing tasks. On the other hand, Intel aims to bolster its standing in the GPU space with its recently announced Arc series, targeting gamers and content creators. Despite these efforts, Intel’s historical dominance in CPUs presents a significant barrier for its GPU ambitions.

Market response has clearly signaled investor confidence in NVIDIA’s innovative capacity, especially given its strong stance in AI adoption across numerous industries. Meanwhile, Intel continues to face challenges, including supply chain issues and delays in their next-generation products, which have affected investor sentiment and stock performance. As both companies pursue advanced technologies, how they adapt to evolving market demands will significantly impact their competitive dynamics and investment potential in the tech landscape.

Risks and Considerations

While investing in NVIDIA (NVDA) stock presents substantial opportunities, it’s essential to consider the potential risks associated with the investment.

Market Volatility

The technology sector, particularly the AI and GPU markets, is known for its inherent volatility. Fluctuations in market sentiment can quickly influence stock prices, as seen during broader economic shifts or industry-specific developments. For NVDA, unexpected challenges such as regulatory changes, increased competition, or changes in consumer demand can lead to significant price swings. Investors should remain vigilant about macroeconomic indicators that may affect overall market health, including interest rates and inflation, as these factors can influence investment strategies and risk tolerance.

Technological Advancements

Another risk to consider is the rapid pace of technological advancement in the sector. As competitors continue to innovate and develop new technologies, NVIDIA must maintain its leadership position by consistently delivering cutting-edge products. Any delays or failures to keep up with emerging trends—such as advancements in AI algorithms, performance enhancements, or energy efficiency—could adversely impact the company’s market share and revenue growth. Thus, ongoing investment in R&D is crucial for NVDA to not only stay relevant but to outpace its rivals.

Supply Chain Challenges

Supply chain issues can also pose significant risks to NVIDIA’s operations. The recent global disruptions have highlighted vulnerabilities related to component sourcing and production. Any further delays or shortages in semiconductor supply can hinder NVIDIA’s ability to meet market demand, potentially leading to lost sales and diminished investor confidence. A cautious approach to managing supply chain relationships and maintaining adequate inventory levels will be vital in mitigating these risks.

Competitive Landscape

The competitive landscape within the AI hardware and GPU industries continues to intensify, with new entrants and established players vying for market share. Companies such as Advanced Micro Devices (AMD) and Intel are not the only challengers; emerging startups focused on niche areas like edge computing and machine learning accelerators are increasingly making their presence felt. These competitors are leveraging unique technologies to disrupt traditional markets, thereby compelling established firms like NVIDIA to adapt and innovate continuously.

Furthermore, partnerships and collaborations are becoming pivotal in this space. For example, NVIDIA has forged alliances with major cloud service providers to enhance its AI offerings, enabling faster deployment of services and better scalability for customers. Similarly, other tech giants are exploring options to combine their resources with startups to accelerate development timelines. This dynamic environment underscores the importance of strategic positioning as firms navigate through technological advancements and evolving customer needs.

As we observe these developments, market participants must remain alert to how companies articulate their value propositions and respond to this fierce competition. The ability to swiftly adapt to changes and leverage new opportunities will ultimately determine the long-term success of these businesses in the burgeoning AI hardware landscape.

Conclusion

In conclusion, the ongoing rivalry between NVIDIA and Intel highlights the dynamic nature of the technology sector, particularly in the domains of AI and GPU development. As each company seeks to strengthen its position, investors should closely monitor their strategic moves, product launches, and market performance. NVIDIA’s ability to innovate in the rapidly evolving landscape of artificial intelligence, alongside its strong foothold in gaming and data centers, presents promising opportunities. Conversely, Intel’s efforts to reclaim its share in the GPU market underscore the challenges it faces in overcoming historical perceptions and adapting to new market realities.

Moreover, investors must remain cognizant of the broader economic conditions and their potential impact on tech stocks. The interplay of market volatility, supply chain dynamics, and competitive pressures will continue to shape the trajectories of these two giants. By keeping a keen eye on these factors and understanding the risks and rewards associated with each company, investors can navigate this complex landscape more effectively, positioning themselves to harness potential growth in the high-stakes competition between NVIDIA and Intel.